This isn’t the “BBB” plan the Biden administration was hoping to create, but inflation is turning holiday cheer into holiday woes as a record number of Americans say they won’t be buying gifts this year. With Cyber Monday now upon us, following the Black Friday post-Thanksgiving rush, retailers have been banking on strong sales to make up for lost revenue in 2020. They might get it, but not from the record level of shoppers who say they’re sitting this one out.

Despite reasonably strong retail growth among Americans who will be buying, an above-average number of shoppers plan to sit this season out entirely with regard to holiday gift spending. High-income households will instead make up the difference with more buying, while low-income households are feeling the double-pinch from Biden’s inflationary policies at the grocery store and the gas pump.

With the consumer confidence index hitting a 10-year low in November, the mixed messages on holiday spending can only be described as the Biden malaise:

Shoppers are spending, but they’re increasingly nervous about opening their wallets.

“The people who had already been struggling before the pandemic right are really struggling now,” said Hilliard. “And everyone that has spent their stimulus are coming in now. Now that the rent moratorium is gone, folks are freaking out.”

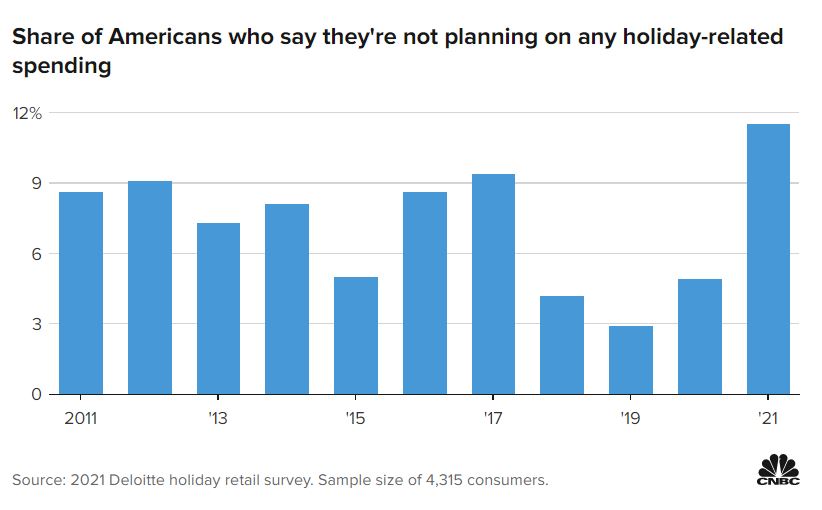

This holiday, 11.5% of people plan to sit out the season by not spending anything on presents, gift cards or other items for entertaining, according to a survey by Deloitte. That’s a record amount of Americans on the sidelines, for as long as the consulting firm has been keeping track.

Here’s the accompanying chart with some annual data back to 2011. Up until this year, 9% was the ceiling of consumers sitting out the holiday shopping season. As of recently, that number is hitting a record high of almost 12%:

It’s worth noting those two recent years, 2018 and 2019, were in the midst of President Trump’s record-setting economy where every income level and household was feeling more financially sound overall with lower fuel prices and stable inflation. As a result, more shoppers were spending on holiday gifts.

Instead, 2021 for many turned sour after Biden’s spending plans and attitude toward fossil fuels sent the economy downward and costs skyrocketing on everyday essentials.

As we noted recently, progressive policies aimed at fixing inequalities typically end up creating more of it, and nowhere is that seen more drastically than the holiday spending numbers which one analyst described as a “tale of two economies”:

Households that bringing in more than $100,000 a year will shell out $2,624 apiece this holiday, up 15% from 2020, Deloitte’s survey found. While lower-income groups, which make less than $50,000 per year, plan to spend $536 per household, a 22% decline from year-ago levels.

Rising fuel costs are regressive in that they disproportionally affect people who can least afford the increase. Yet the way the Biden administration dismisses these concerns out of hand seems town deaf and discriminatory as they laugh about delayed treadmills or literally refer to concerns over the economy as “high class problems,” as Biden’s Chief of Staff did recently:

This ?? https://t.co/ymh53nEHAg

— Ronald Klain (@WHCOS) October 14, 2021

With this attitude of laughing off inflation while it crushes households at the lower end of the income spectrum, the mask has slipped and Biden’s campaign of empathy has turned into a campaign of misery for many Americans. Democrats claim to be the party of the working class, yet their policies end up destroying working-class households with anti-growth policies that crush budgets and devour disposable income.

Nowhere more immediate has this been evident than Dollar Tree stores moving their typical $1.00 price point to $1.25, a 25 percent increase:

Inflation has been widespread — even dollar stores have had to take increases. Dollar Tree is bumping its price floor to $1.25, in an attempt to offset the pressure it faces from increased freight costs. But it still believes that the slightly higher price is competitive.

“We believe that at $1.25, it’s still going to be an undeniable value because of what [shoppers are] seeing out in the marketplace,” said Dollar Tree CEO Michael Witynski, on an earnings call this week.

A 25 percent jump in just about anything would be a sticker shock for most consumers. In this case, not even dollar store shoppers can avoid Biden’s inflationary policies eating more of their budget on common household items, leaving less for holiday gift spending.

You don’t have to look far or deep to see how soft the economy is under the headlines portrayed by the Biden administration. Bidenomics is failing, and it’s hurting Americans in the process.

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts