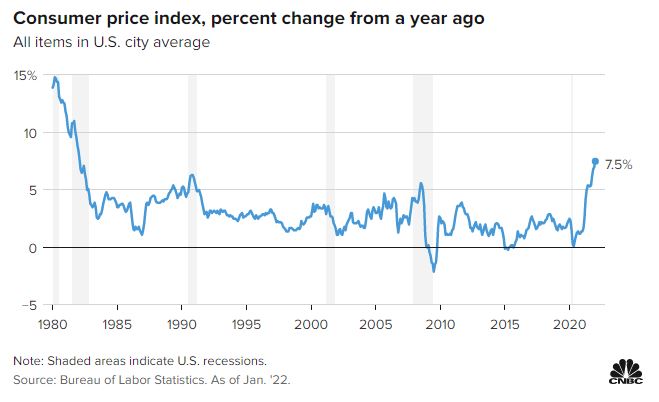

Just in time for Sen. Joe Manchin to ride in and say, “I told you so,” here’s the annual consumer price index report showing that inflation rose 7.5% in 2021, the highest annual level since 1982 when costs were coming down from the malaise of the Carter years.

For Biden and Dems looking ahead to the midterms, this number is an unmitigated disaster, and flies in the face of claims the inflation situation is somehow temporary:

Consumer prices surged more than expected over the past 12 months, indicating a worsening outlook for inflation and cementing the likelihood of substantial interest rate hikes this year.

The consumer price index for January, which measures the costs of dozens of everyday consumer goods, rose 7.5% compared with a year ago, the Labor Department reported Thursday.

That compared with Dow Jones estimates of 7.2% for the closely watched inflation gauge. It was the highest reading since February 1982.

The chart is pretty gruesome for Biden, and spells out exactly the concerns that Republicans, and a handful of Democrats, have expressed about excessive government spending:

As noted, you have to scroll all the way back to 1982 before you see numbers in the sevens, and that was at a time when inflation was coming down rapidly.

Joe Manchin took an “I told you so” lap with a statement pointing out his concerns being realized:

New Manchin statement on inflation figures: "As inflation and our $30 trillion in national debt continue a historic climb, only in Washington, DC do people seem to think that spending trillions more of taxpayers’ money will cure our problems, let alone inflation." pic.twitter.com/WFZ8cVJ08e

— Grace Panetta (@grace_panetta) February 10, 2022

“Highest Inflation in Four Decades” is hardly the campaign slogan Democrats want to run on in November, but it’s a mess they helped create with trillions of dollars in spending being tossed around like Tic Tacs.

This is not a record Biden wants to hold, but it’s another bad record number to add to the overflowing trophy case:

The monthly CPI rates also came in hotter than expected, with headline and core CPI both rising 0.6%, compared with the estimates for a 0.4% increase by both measures.

Stock market futures declined following the report, with rate-sensitive tech stocks hit especially hard. Government bond yields rose sharply, with the benchmark 10-year Treasury note touching 2%, its highest since August 2019.

Markets also got more aggressive in pricing rate hikes ahead.

Beating expectations with higher than expected inflation is a great summary of Biden’s presidency as a whole. We expected it to be bad, but not this bad.

Once again, Democrats and the Biden administration are caught flat-footed on the meat and potatoes issues of consumer prices continuing to skyrocket, putting a pinch on households of every income level. From food to fuel, the prices just keep rising amid supply issues and labor shortages.

It truly is a perfect storm of terrible economic and legislative policy wrapped up in one to achieve an inflation level not seen in forty years.

Biden has continued downplaying the problem, perhaps just assuming it’ll go away if reporters stop asking about it? Well, it’s not going away, it’s only getting worse.

If the trend continues, the number could be several points higher by the summer or fall heading into the midterms. The problem right now for the White House is that once the inflation train gets rolling, there isn’t a lot the government can actively do to slow it down.

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts